Why Forecast Receipts?

The broader field of cash flow forecasting is integral to ensuring organizational liquidity. Maintaining cash receipts over a given time frame enables organizations to have cash at hand in a predictable fashion, thus allowing them to reinvest in business operations to avoid the opportunity cost of having unused cash and cash receivables. Forecasting cash inflows and outflows in advance is a primary role of corporate financiers and accountants, and enables efficient use of existing assets to capture maximum competitive value in the marketplace.

Cash Receipts and Disbursements (R&D)

The direct method of projecting incoming cash flow is through understanding cash receipts and disbursements of the time period being projected.

Receipts

Receipts generally refer to the collection of accounts receivable, which are the payments of paying customers over time. Receipts also refer to the returns off of short-term investments as well as the sale of various assets. There are other potential incoming cash flows that also fall under receipts, which are worth noting on a case by case basis.

Disbursements

On the inverse side of receipts, disbursements are outgoing cash flows during a short-term business operation. These can quite accurately project accounts payable, payroll costs, dividend payments, interest payments, and other short-term alterations to existing cash flow. By comparing receipts with disbursements, the overall available cash flow can be derived.

How to Forecast Receipts

As with all forecasting, shorter term forecasts are more certain than longer term forecasts (in general). Short term forecasts can be quite accurate, as the various accounts receivable, accounts payable, short-term investments and short-term costs are often relatively established (contractually and operationally). In shorter term situations, most forecasting is done through implementing what is known with the probability that these obligations will be met.

With longer term forecasting, it can be useful to consider past averages over time. Larger organizations can look at their average cash receipts over the past few years, and couple that with growth trajectories to project what level of cash inflow is likely over a given time frame. It's important to keep in mind that forecasts are only estimations, and organizations should be aware of the error margins involved.

Normal Distributions

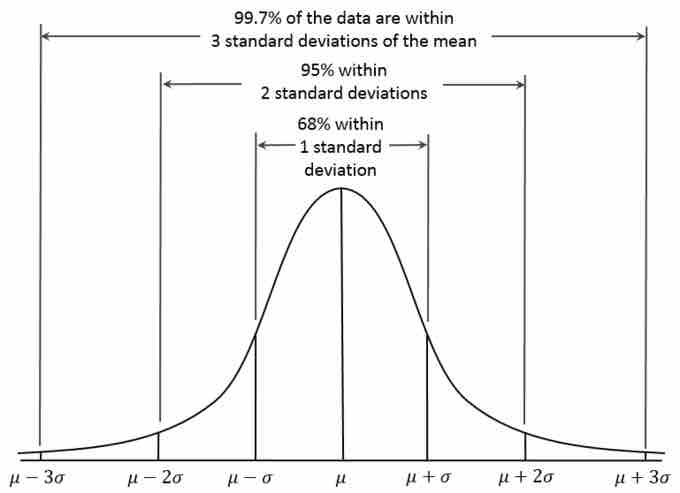

When creating a forecast utilizing past data, it is important to recognize the degree of certainty that can be reasonably applied to this forecast. By creating a normalized distribution, and identifying the percentage likelihood of a certain outcome, organizations can better prepare for all likely outcomes.