Section 3

Internal Rate of Return

By Boundless

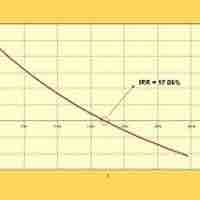

IRR is a rate of return used in capital budgeting to measure and compare the profitability of investments; the higher IRR, the more desirable the project.

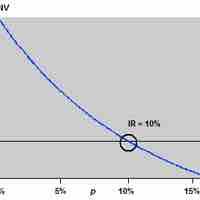

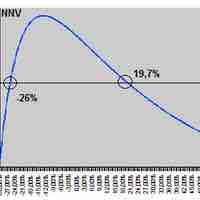

Given a collection of pairs (time, cash flow), a rate of return for which the net present value is zero is an internal rate of return.

The IRR method is easily understood, it recognizes the time value of money, and compared to the NPV method is an indicator of efficiency.

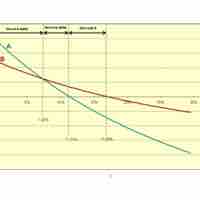

IRR can't be used for exclusive projects or those of different durations; IRR may overstate the rate of return.

When cash flows of a project change sign more than once, there will be multiple IRRs; in these cases NPV is the preferred measure.

The MIRR is a financial measure of an investment's attractiveness; it is used to rank alternative investments of equal size.