Par value, in finance and accounting, means the stated value or face value. From this comes the expressions at par (at the par value), over par (over par value) and under par (under par value). A bond selling at par has a coupon rate such that the bond is worth an amount equivalent to its original issue value or its value upon redemption at maturity. Corporate bonds usually have par values of $1,000 while municipal bonds generally have face values of $500. Federal government bonds tend to have much higher face values at $10,000.

A typical bond makes coupon payments at fixed intervals during the life of it and a final repayment of par value at maturity. Together with coupon payments, the par value at maturity is discounted back to the time of purchase to calculate the bond price.

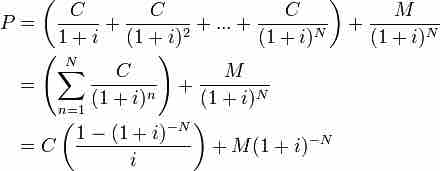

Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate .

Bond Price Formula

Bond price is the present value of coupon payments and the par value at maturity.

F = face value, iF = contractual interest rate, C = F * iF = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed/ appropriate yield to maturity, M = value at maturity, usually equals face value, P = market price of bond.

Par value of a bond usually does not change, except for inflation-linked bonds whose par value is adjusted by inflation rates every predetermined period of time. The coupon payments of such bonds are also accordingly adjusted even though the coupon interest rate is unchanged.