The payment schedule of financial instruments defines the dates at which payments are made by one party to another on, for example, a bond or a derivative. It can be either customised or parameterized. Payment frequency can be annual, semi annual, quarterly, monthly, weekly, daily, or continuous.

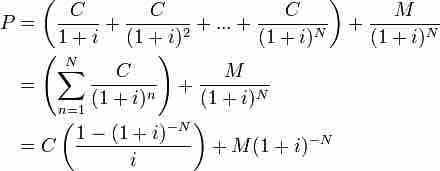

Bond prices is the present value of all coupon payments and the face value paid at maturity. The formula to calculate bond prices:

Bond price formula

Bond price is the present value of all coupon payments and the face value paid at maturity.

F = face value, iF = contractual interest rate, C = F * iF = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, P = market price of bond.

In other words, bond price is the sum of the present value of face value paid back at maturity and the present value of an annuity of coupon payments. For bonds of different payment frequencies, the present value of face value received at maturity is the same. However, the present values of annuities of coupon payments vary among payment frequencies.

The present value of an annuity is the value of a stream of payments, discounted by the interest rate to account for the payments are being made at various moments in the future. The formula is:

Annuity formula

The formula to calculate PV of annuities.

Where n is the number of terms or number of payments n =1 (annually), n = 2 (semi-annually), n = 4 (quarterly)... and i is the per period interest rate.

According to the formula, the greater n, the greater the present value of the annuity (coupon payments). To put it differently, the more frequent a bond makes coupon payments, the higher the bond price.