In finance, maturity date or redemption date, refers to the final payment date of a loan or other financial instrument, at which point the principal (and all remaining interest) is due to be paid.

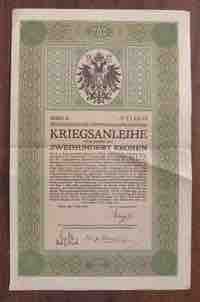

Austrian war bond

The first Austrian bonds had 5% rates of return and a five-year maturity.

The issuer has to repay the nominal amount on the maturity date. As long as all due payments have been made, the issuer has no further obligations to the bond holders after the maturity date. The length of time until the maturity date is often referred to as the term or tenor or maturity of a bond. The maturity can be any length of time, although debt securities with a term of less than one year are generally designated money market instruments rather than bonds. Most bonds have a term of up to 30 years. Some bonds have been issued with terms of 50 years or more and, historically, there have been some issues with no maturity date (irredeemables).

In the market for United States Treasury securities, there are three categories of bond maturities:

- short term (bills): maturities between 1 to 5 years (instruments with maturities less than one year are called "Money Market Instruments");

- medium term (notes): maturities between 6 to 12 years; and

- long term (bonds): maturities greater than 12 years.

Normally the maturity of a bond is fixed. However, it is important to note that bonds are sometimes "callable,"which means that the issuer of the debt is able to pay back the principal at any time. In this case, the maturity date is the day when the bond is called. Thus, investors should inquire, before buying any fixed-income securities, whether the bond is callable or not. Bonds can also be puttable, meaning that the holder has the right, but not the obligation, to demand early repayment of the principal. Similarly, the maturity date, if applicable, is the date as the bond is redeemed.