Concept

Version 5

Created by Boundless

Default Risk

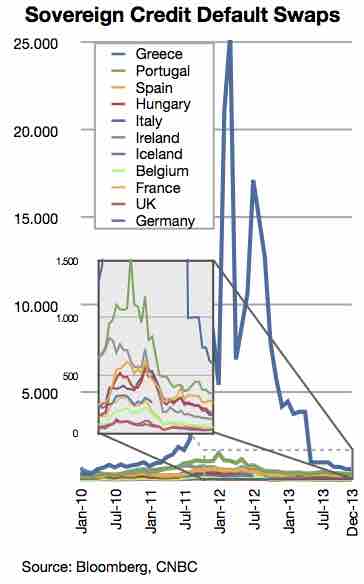

Prices of sovereign credit default swaps

Credit default swaps are an instrument to protect against default risk. This image shows the monthly prices of sovereign credit default swaps from January 2010 till September 2011 of Greece, Portugal, Ireland, Hungary, Italy, Spain, Belgium, France, Germany, and the UK (Greece is illustrated by blue line). Higher credit default swap prices mean that investors perceive a higher risk of default.

Source

Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources: