Operating Margin

The financial job of a company is to earn a profit, which is different than earning revenue. If a company doesn't earn a profit, their revenues aren't helping the company grow. It is not only important to see how much a company has sold, it is important to see how much a company is making.

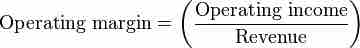

The operating margin (also called the operating profit margin or return on sales) is a ratio that shines a light on how much money a company is actually making in profit. It is found by dividing operating income by revenue, where operating income is revenue minus operating expenses .

Operating margin formula

The operating margin is found by dividing net operating income by total revenue.

The higher the ratio is, the more profitable the company is from its operations. For example, an operating margin of 0.5 means that for every dollar the company takes in revenue, it earns $0.50 in profit. A company that is not making any money will have an operating margin of 0: it is selling its products or services, but isn't earning any profit from those sales.

However, the operating margin is not a perfect measurement. It does not include things like capital investment, which is necessary for the future profitability of the company. Furthermore, the operating margin is simply revenue. That means that it does not include things like interest and income tax expenses. Since non-operating incomes and expenses can significantly affect the financial well-being of a company, the operating margin is not the only measurement that investors scrutinize. The operating margin is a useful tool for determining how profitable the operations of a company are, but not necessarily how profitable the company is as a whole.