The Federal Reserve (Fed) has an ability to directly influence economic growth and stability through the use of monetary policy. Though the central bank can directly influence the money supply the majority of its activities center around interest rates, the outcome of changes to the money supply.

Interest Rate Mechanism

The Fed can set a reserve ratio, which is in effect the required reserves (percentage of deposits) that a bank must hold either on site or at the Fed. The requirement must be satisfied on a daily basis. However, given daily bank dynamics of withdrawals, deposits and loan of funds some banks may fall short of their daily reserve requirement. For banks in need of reserve funds, the overnight or short-term bank loan market is available.

Banks can seek to borrow from other banks holding funds at the Fed. The rate that Fed member banks charge one another is referred to as the Federal Funds rate, or Fed Funds rate for short (rate for funds held at the Fed). The rate is indirectly influenced and targeted by the Fed via a direct channel of open market operations and is communicated to the public as a Fed Funds target range as a standard part of the Fed Open Market Committee communications. It is important to note that the Fed does not set the fed funds target rate, it only issues a range that it targets through active management of the money supply.

Using its open market channel, the Fed buys government bonds to increase the money supply and sells the same bonds to reduce it. Adding to the money supply will typically lead to lower interest rates, while reducing the money supply will increase interest rates. The Fed actively adjusts the buying and selling of bonds to achieve the target interest rate. This in turn impacts the rate that Fed member banks are willing to charge each other for overnight loans, or the Fed Funds rate. The fed funds rate will be within the range of the target; if not the Fed will adjust its open market operations (buying and selling of bonds) to achieve the range .

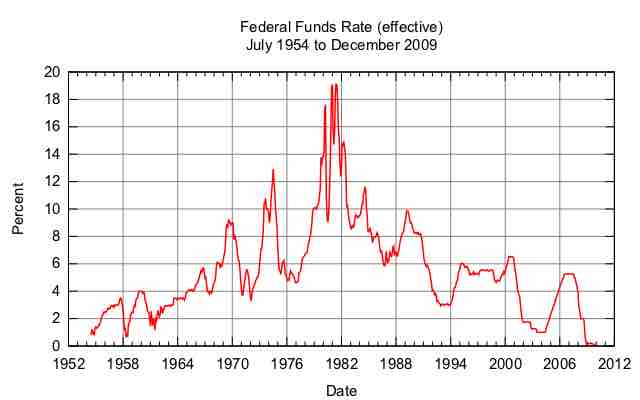

Historical effective federal funds target rate

The graphic depicts the movement in the effective federal funds target rate. The target rate has historically been set in terms of a range; the current range as depicted in the graph is 0.00 to 0.25 percent.