Economic Rationale

Rationale is defined as an explanation of the basis or fundamental reasons for something. In economics, rationale are the reasons or thought processes that impact economic decisions. The interest rate is one of the primary influences on economic rationale.

Interest Rate

The interest rate is the rate at which interest is paid by a borrower (debtor) for the use of money borrowed from a lender (creditor). It is the percent of principal paid a certain amount of times per period.

Impact of the Interest Rate

The interest rate guides economic rationale because it is a vital tool of monetary policy. The interest rate is taken into account when dealing with economic variables such as investment, inflation, and unemployment. Central banks usually reduce the interest rate to increase investment and consumption in the country's economy. The interest rate directly impacts economic choices such as spending, investment, and consumption .

Interest Rates

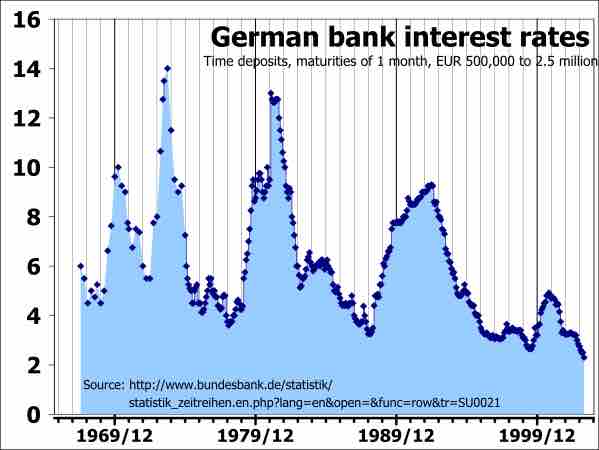

This graph shows the fluctuation in interest rates in Germany from 1967 to 2003. The interest rates reached 14% in 1969 and lowered to 2% by 2003. The interest rate in an economy directly impacts economic choices including spending, investment, and consumption.

Interest rates also influence inflationary expectations. People form an expectation of what will happen to inflation in the future. The current and projected interest rates are influential in these economic expectations. Investments are made based on the nominal interest rate and the degree of risk involved. Low interest rates are enticing, but can be problematic if an economic bubble forms. For example, low interest rates can lead to large amounts of investments poured into the real-estate market and stock market. When these bubbles pop, the investments fail, resulting in large unpaid debts and financial bankruptcy for individuals and banking institutions.

When interest rates increase, investments decrease, which causes the national income to fall. High interest rates do encourage more savings, which over time leads to more investment and higher levels of employment to meet production needs. Higher rates discourage economically unproductive lending such as consumer credit and mortgage lending.

The interest rate also directly impacts money and inflation because the government can affect the markets and alter the total of loans, bonds, and shares that are issued. When the interest rate is lower, it usually increases the broad supply of money. An increase in the money supply leads to inflation.