Retirement is the point where a person stops employment completely. A person may also semi-retire by reducing work hours. Many people choose to retire when they are eligible for private or public pension benefits, although some are forced to retire when physical conditions no longer allow the person to work (by illness or accident) or as a result of legislation concerning their position.

International Views on Retirement

In most countries, the idea of retirement is of recent origin, being introduced during the late 19th and early 20th centuries. Previously, low life expectancy and the absence of pension arrangements meant that most workers continued to work until death. Germany was the first country to introduce retirement. Most developed countries today have systems to provide pensions or retirement, which may be sponsored by employers and/or the state. In many poorer countries, support for the old is still mainly provided through the family.

Retirement with a pension is considered a right of the worker in many societies. Hard ideological, social, cultural and political battles have been fought over whether this is a right. In many western countries, this right is mentioned in national constitutions. While conventional wisdom has it that one can retire and take 7 percent or more out of a portfolio year after year, this would not have worked in the past. Making periodic inflation-adjusted withdrawals from retirement savings can make meaningless many assumptions that are based on long term average investment returns.

Post-Retirement Finances

Those contemplating early retirement will want to know if they have enough to survive possible bear markets. The history of the U.S. stock market shows that one would need to live on about 4 percent of the initial portfolio per year to ensure that the portfolio is not depleted before the end of the retirement. This allows for increasing withdrawals with inflation to maintain a consistent spending ability throughout the retirement, and to continue making withdrawals even in dramatic and prolonged bear markets. The 4 percent figure does not assume any pension or change in spending levels throughout the retirement.

When retiring prior to age 59½, there is a 10 percent IRS penalty on withdrawals from a retirement plan like a 401(k) plan or a Traditional Individual Retirement Account (IRA). Exceptions apply under certain circumstances. At age 59 and six months, the penalty-free status is achieved and the 10 percent IRS penalty no longer applies. To avoid the 10 percent penalty prior to age 59½, a person should consult a lawyer about the use of IRS rule 72 T. This rule must be applied for with the IRS. It allows the distribution of a IRA account prior to age 59½ in equal amounts of a period of either 5 years or until the age of 59½, which ever is the longest time period without a 10 percent penalty. Taxes still must be paid on the distributions.

Navy Retiree

In addition to traditional retirement benefits from 401(k)s or IRAs, military personnel are eligible for veterans benefits from things such as the G.I. Bill.

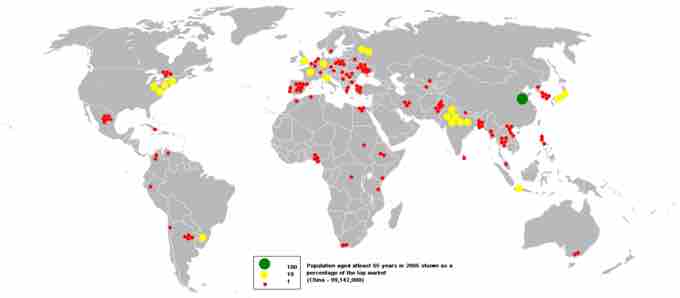

World Pop 65+, retirement age

This bubble map shows the global distribution of population aged at least 65 years in 2005 as a percentage of the top nation (China - 99,142,000).