A bond is a financial security that is created when a person transfers funds to a company or government, with the understanding that at some point in the future the entity issuing the bond will have to repay the amount, plus interest . Generally, the person who holds the actual bond document is the one with the right to receive payment. This allows people who originally acquire a bond to sell it on the open market for an immediate payout, as opposed to waiting for the issuing entity to pay the debt back. Note that the trading value of a bond (its market price) can vary from its face value depending on differences between the coupon and market interest rates.

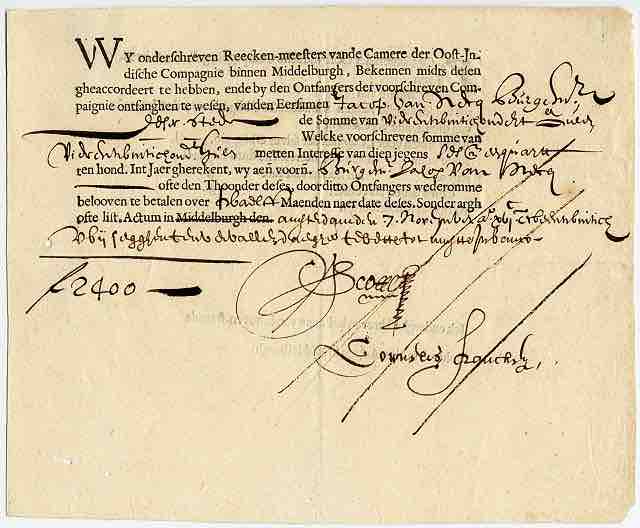

A bond from the Dutch East India Company

A bond is a financial security that represents a promise by a company or government to repay a certain amount, with interest, to the bondholder.

A bond's book value is determined by several factors.

Term

A bond's term, or maturity, is how long the issuing company has until it must repay the entirety of what it owes. Sometimes a business will make interest payments during the term of the bond, but a term ends when all of the payments associated with the bond are completed.

Face Value of Bond

Otherwise known as the principal or nominal amount, this is the amount of money that the organization issuing the bond has to pay interest on and generally has to repay when the bond is redeemed at the end of the term. The redemption amount generally equals how much the original investor paid to acquire the bond. However, the redemption amount can be different than the acquisition cost.

Coupon

A bond's coupon is the interest rate that the business must pay on the bond's face value. These interest payments are generally paid periodically during the bond's term, although some bonds pay all the interest it owes at the end of the period. While the coupon rate is generally a fixed amount, it can also be "indexed. " This means that the interest rate is calculated by taking an established rate that fluctuates over time, such as a bank's lending rate, and adding a "premium" percentage amount to determine the bond's coupon rate. As a result, the interest that is paid to the bond holder fluctuates over time with an indexed coupon rate.

Discount Rate

A bond's value is measured based on the present value of the future interest payments the bond holder will receive. To calculate the present value, each payment is adjusted using the discount rate. The discount rate is a measure of what the bondholder's return would be if he invested his money in another security. In practical terms, the discount rate generally equals the coupon rate or interest rate associated with similar investment securities.