Bonds issued at par value are relatively simple to calculate and record. When a bond is issued at par value it is sold for the face value amount. This generally means that the bond's market and contract rates are equal to each other, meaning that there is no bond premium or discount.

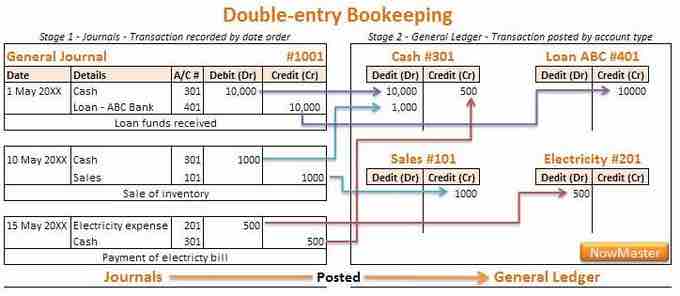

The General Ledger

All transactions made by the company in relation to the bond must be recorded in its general ledger. The general ledger contains all entries from both the General Journal and the Special Journals.

When a business issues a bond, it participates in three types of transactions. First, the business issues the bond in exchange for cash. Next, it generally pays interest during the term of the bond. Finally, it pays off the obligation by repaying the face amount and the last interest payment. Each of these transactions must be recorded in the company's financial records with a series of journal entries.

Issuing the Bond

When the bond is issued, the company must record a liability called "bond payable. " This is generally a long-term liability. It is created by recording a credit equal to the face value of all the bonds that are issued. To balance this entry, the company must also debit cash equal to the face value of all the bonds issued. Since the bonds are sold at par value, the amount of cash the company receives should equal the total face value of the issued bonds.

Cash - debit face value (increase cash balance)

Bond payable - credit face value (increase bonds payable)

Interest Payments

When the company makes an interest payment, it must credit, or decrease, its cash balance by the amount it paid in interest. To balance the entry, the company must record a debit equal to the amount it paid in its bond interest expense account.

Bond Interest Expense - debit interest payment (increase interest expense line)

Cash - credit interest payment (decrease cash balance)

Paying Off the Bond

When the bond is paid off, the company must record two transactions. First, it must record any final interest payments that are made. Then, it must record the bond principal being paid off. This is done by debiting the bond payable account and crediting the cash account for the full book value of the bond.

Bond Interest Expense - debit interest payment

Cash - credit final interest payment

Bond Payable - debit face value

Cash - credit face value