Financial Statement Notes

The goal of the financial statements is to convey the financial information about a company in an easy to understand format. While the Income Statement, Balance Sheet, Cash Flow Statement, and Statement of Retained Earning contain all numeric information about the company, these numbers often require a better explanation. So, additional supporting financial data is added in the Financial Statement Notes section. . Including notes to the financial statement is not optional, it is a reporting requirement.

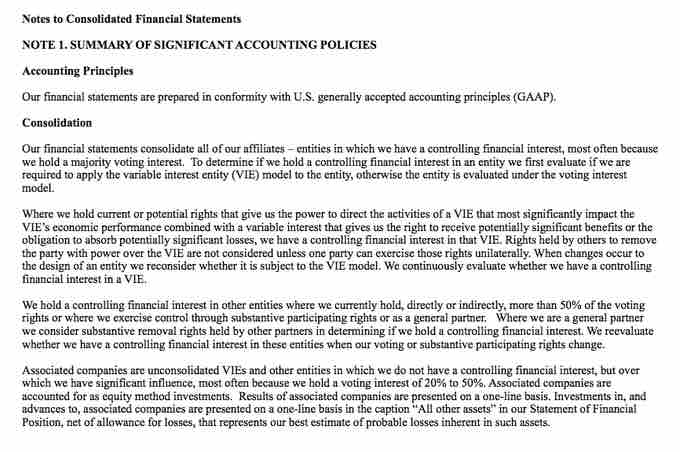

GE Financial Statement

Notes on the financial statements convey specific information about the line-items on the statement.

Where the Notes are Located

Notes to financial statements are added to the end of financial statements. These notes help explain specific items in the financial statements. They also provide a more comprehensive assessment of a company's financial condition.

Items Included in the Financial Statement Notes

Notes to financial statements can include information and supporting data on debt, going concern criteria, accounts, contingent liabilities, or contextual information explaining the financial numbers (for example, if the company is facing a lawsuit).

The Purpose of Financial Statement Notes

The notes clarify individual line items on the various statements. For example, if a company lists a loss on a fixed asset impairment line in their income statement, notes could corroborate the reason for the impairment by describing how the asset became impaired. Notes can also explain the accounting methods used to prepare the statements. The notes support valuations for how particular accounts have been computed. In consolidated financial statements, all subsidiaries are listed as well as the amount of ownership (controlling interest) that the parent company has in the subsidiaries. Any items within the financial statements that are valuated by estimation are part of the notes if a substantial difference exists between the amount of the estimate previously reported and the actual result. Full disclosure of the effects of the differences between the estimate and actual results should be included.