Amortization of Intangible Assets

Under US GAAP, the cost of intangible assets are either amortized over their respective useful/legal lives, or are tested for impairment on an annual basis. Amortization is the systematic write-off of the cost of an intangible asset to an expense, which effectively allocates a portion of the intangible asset's cost to each accounting period in the economic or legal life of the asset (an amortization expense). Only recognized intangible assets with finite useful lives are amortized. This differs from tangible assets which are depreciated (resulting in a depreciation expense) over their useful life.

Useful Lives

Intangible assets have a useful life that is either identifiable or indefinite. Intangible assets with identifiable useful lives are amortized on a straight-line basis over their economic or legal life, whichever is shorter. The finite useful life of an intangible asset is considered to be the length of time it is expected to contribute to the cash flows of the reporting entity. Pertinent factors that should be considered in estimating the useful lives of intangible assets include legal, regulatory, or contractual provisions that may limit the useful life.

Costs of Intangible Assets

Firms may only include the immediate purchase costs of an intangible asset, which do not include the costs associated with internal development or self-creation of the asset. If an intangible asset is internally generated in its entirety, none of the costs related to the asset are capitalized.

Straight Line Amortization vs. Testing for Impairment

An intangible asset is amortized if the asset has an identifiable useful life. The annual expense recognized as a result of straight line amortization is simply the cost of the intangible asset divided by the number of years in it's estimated useful life. The amortization expense recognized each year will be the same, and the value of the intangible asset will be 0 at the end of its useful life

Example:

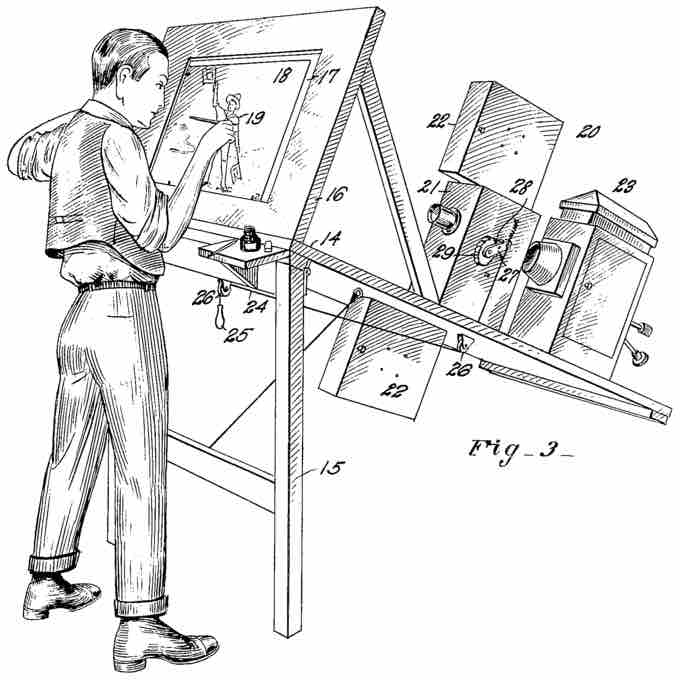

Company X purchases a patent for $17,000, which enables the owner to manufacture, sell, lease, or otherwise benefit from an invention for 17 years. Company X would recognize an intangible asset valued at $17,000 and amortize that cost over 17 years. Each year, Company X will recognize an expense of $1,000 in addition to decreasing the value of the patent reported on the balance sheet by $1,000. See the figure below for an example of a U.S. patent .

Example Patent Drawing

An example of a U.S. Patent drawing

Scenario A: After 5 years Company X is sued for patent infringement and is required to hire a lawyer. The patent lawyer charges $10,000 and is successful in defending Company X's patent. The $10,000 spent to defend the patent is capitalized to the value of the patent on Company X's balance sheet and then amortized over the remaining 12 years of the patent's legal life.

Scenario B: After 5 years Company X realizes that their patent is worthless due to advances in technology. As a result of the useful life of their patent being reduced from 17 years to just 5 years, the remaining unamortized value of $12,000 is expensed and the patent is written down to a value of $0.

Goodwill is an example of an intangible asset that has an indefinite useful life, and is therefore tested for impairment on an annual basis as opposed to being amortized on a straight line basis. A company cannot purchase goodwill by itself; it must buy an entire business or a part of a business to obtain the accompanying intangible asset. Under current US GAAP, firms are required to compare the fair value of reporting units to the respective reporting unit's book value, which is calculated as assets plus goodwill less liabilities. If the fair value of the reporting unit is less than its carrying value, goodwill has been impaired. An impairment loss is recognized on the income statement and the goodwill account is reduced. The impairment loss is calculated by subtracting the fair value of a reporting unit's net assets from the reporting unit's carrying value.