Limited-Life Impairment

Intangible assets are non-monetary assets that cannot be seen, touched, or physically measured. Intangible assets are created through time and effort, and are identifiable as separate assets. They are classified into categories: either purchased vs. internally created intangible assets; and limited-life or indefinite-life intangible assets.

The two primary forms of intangibles are legal intangibles, which includes trade secrets, copyrights, patents, and trademarks (also referred to as Intellectual Property) and competitive intangibles, which includes knowledge activities, collaboration activities, leverage activities, and structural activities. Limited-life intangibles are intangible assets with a limited useful life, such as copyrights, patents and trademarks

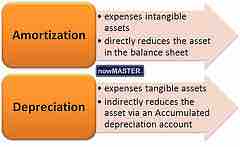

Intangible assets are amortized to reflect their consumption, expiry, obsolescence or other decline in value as a result of use or the passage of time, process which is similar to the deprecation process for tangible assets. Intangible assets can have either a limited or an indefinite useful life. Intangible assets with a limited-life are amortized on a straight-line basis over their economic or legal life, based on whichever is shorter. Examples of intangible assets with a limited-life include copyrights and patents. Only intangible assets with an indefinite life are reassessed each year for impairment.

Limited-life intangibles are systemically amortized throughout the useful life of the intangible asset using either units of activity method or straight-line method. The amortization amount is equal to the difference between the intangible asset cost and the asset residual value. That calculated amount is credited to either the appropriate intangible asset account or accumulated amortization account .

Amortization & depreciation in the accounting cycle

A bond's discount amount must be amortized over the term of the bond.

Reversal of Impairment Loss

When an intangible asset's impairment reverses and value is regained, the increase in value is recorded as a gain on the income statement and reduction to accumulated impairment loss on the balance sheet, up to the amount of impairment loss recorded in prior periods. Increases in value in excess of prior impairment loss are debited directly to the asset and credited to a revaluation reserve account in the equity section of the balance sheet. Asset amortization for future periods should be adjusted due to the increase in value.